Power of Attorney: What It Is and How to Use It

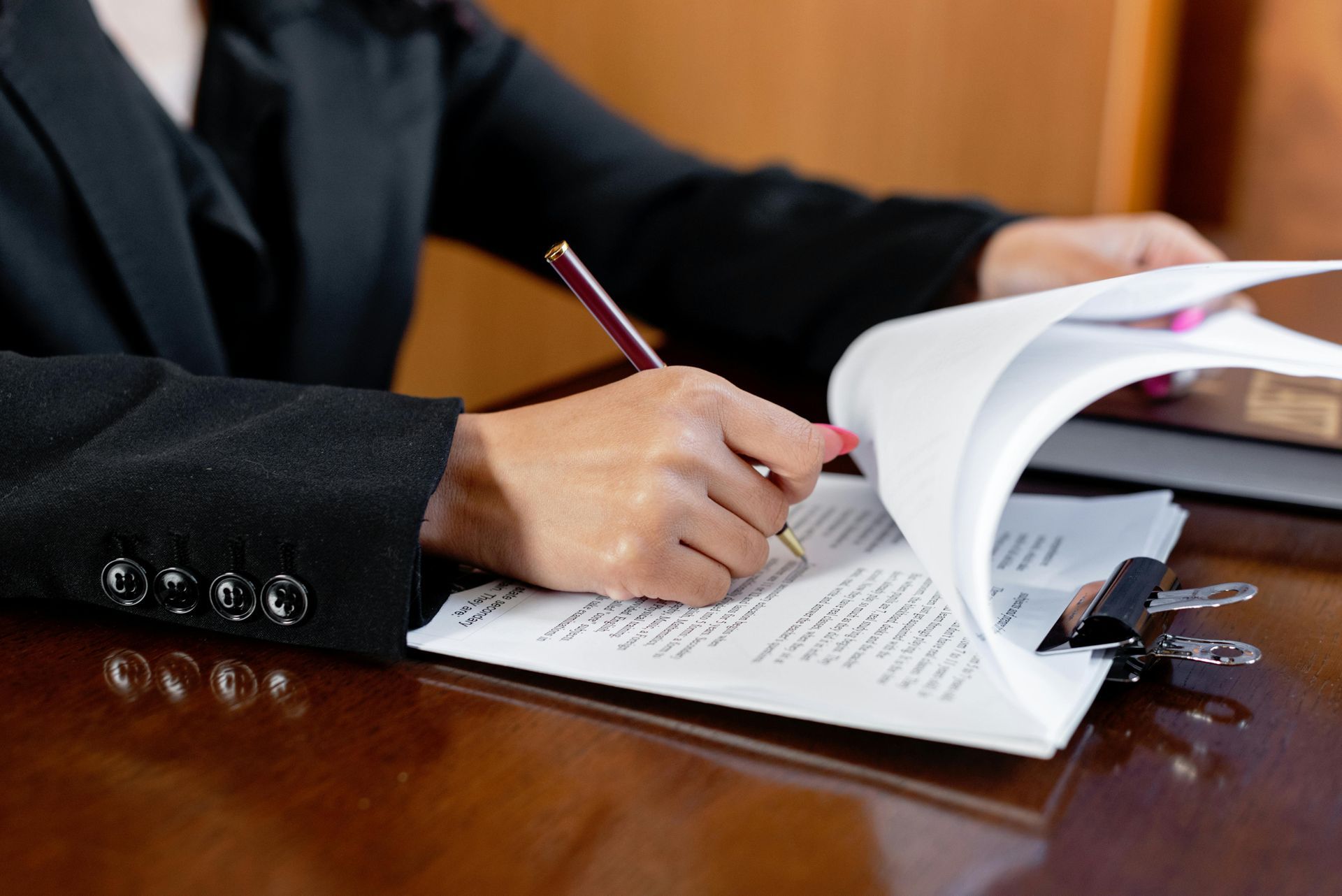

There's a lot to cover when planning your estate. From wills to trusts to guardianship, it's a lot to think about. Throughout the planning process, you'll likely come across the term "power of attorney." While it may be easy to gloss over at first, a power of attorney is actually an essential part of a proper estate plan. Here's what you need to know about powers of attorney.

What is a Power of Attorney?

A power of attorney is a legal document that appoints a trusted person to manage your affairs. This document is necessary in the event you cannot manage your affairs on your own, whether it's due to illness, a disability or age. The agent you designate will be responsible for your financial and medical affairs, as well as any property or other assets you own.

Power of Attorney Types

A power of attorney can come in several forms. The most basic is a general power of attorney, which allows your agent to act on your behalf in all allowable situations. This includes everything from physical health to legal matters.

A limited power of attorney gives your agent power over specific aspects of your affairs. For example, a financial power of attorney can legally manage your savings and assets, while a medical power of attorney can make decisions regarding your health. Depending on your state, these types of decisions are not included in a general power of attorney and will require separate documents.

Non-lasting powers of attorney become invalid in the event you become incapacitated. Conversely, lasting powers remain in effect even if you are unable to make decisions.

Do You Need a Power of Attorney?

According to the National Library of Medicine, everyone should have a power of attorney in place. At first, discussing who will take on this serious responsibility may lead to some emotional conversations. Plus, the chance you'll need a power of attorney might seem slim.

In reality, this is a crucial part of anyone's estate plan. Illness and injury can occur unexpectedly, leaving you unable to manage your everyday affairs. When this happens, being left without a power of attorney can exacerbate an already difficult situation. To prevent this, it's important to establish one as soon as possible.

Get Started With Elder Law Attorneys

If you aren't part of the half of adults who already have a power of attorney in place, there is no better time to start. And for residents of Melbourne, Florida, Elder Law Attorneys is the perfect partner.

A properly planned estate will protect you and your loved ones in the event of an accident. Contact Elder Law Attorneys today to complete your plan with a power of attorney.

You might also like